How Much is my Home in Palm Beach County, FL Worth?

Overview of the Home Valuation Process

When determining how much your house is worth in Palm Beach County, FL, there are various factors to consider. In today’s digital age, online tools have become increasingly popular for estimating home values. These tools use algorithms and data from public records, such as square footage, sale prices of similar properties, and current market conditions, to provide homeowners with an estimate of their property’s value.

While online tools can be a starting point to get a general idea of your home’s worth, it’s important to understand their limitations. One major drawback is the possibility of missing data. These tools rely solely on available information, which may only sometimes be up-to-date or complete. Factors such as recent renovations, special features, or changes in the local housing market may not be accurately reflected in the estimate.

It’s crucial to incorporate additional information to ensure a more accurate valuation. Our Simple Sale™ price, for example, is based on real-time data from recent sales in your area, providing a more precise value for your home. Consulting a real estate professional can greatly assist in the valuation process. Real estate appraisers have extensive knowledge of local market trends and current market conditions. They can help you understand the external factors influencing your home’s value, such as curb appeal and nearby amenities.

In conclusion, while online tools can provide a ballpark estimate of your home’s worth, they should be used cautiously due to limitations. Incorporating additional information, such as the Simple Sale™ price and the expertise of a real estate agent, can help you make a more informed decision about your property’s value.

Real Estate Agent Services

When determining the value of your house in Palm Beach County, Florida, many homeowners turn to real estate agents for assistance. These professionals deeply understand the housing market and can provide valuable insights into your property’s worth in Palm Beach County, FL. However, not everyone may want to utilize the services of a realtor. Some individuals prefer to sell their properties without an agent’s involvement, and many companies nowadays offer you the same as a realtor would, but for a fraction of the cost. In such cases, alternative options are available to help homeowners accurately determine the value of their homes. By leveraging online tools, accessing public records, and seeking guidance from other real estate professionals, individuals can still make informed decisions about their property’s worth without the assistance of a real estate agent. We aim to provide sellers with these alternative solutions, offering a cost-effective and efficient way to sell their homes confidently.

Comparative Market Analysis Tool (CMA)

A Comparative Market Analysis tool (CMA) is a valuable calculator provided by real estate agents to determine the value of your home in Palm Beach County Florida. This free report compares your property to similar homes in the neighborhood, considering market conditions, location, amenities, and overall condition. Agents can accurately estimate your house’s worth by analyzing recent sales of comparable properties.

A CMA considers various factors that can influence the value of a property. Market conditions, such as current prices and trends, significantly determine the value. The location of your home, including the school district and zip code, is also considered. Furthermore, the CMA evaluates your property’s amenities, special features, overall condition, and curb appeal.

Real estate professionals utilize their expertise, access to sales and tax records, and housing market knowledge to compile a comprehensive CMA. By comparing your property to similar homes that have recently sold, they can provide you with an accurate valuation that reflects the fair market value of your property.

A Comparative Market Analysis is a valuable resource for homeowners looking to make informed decisions about their property. It provides a ballpark estimate of what your house is worth and can help determine the listing price. Whether you are considering selling, refinancing, or just curious about your property’s value, a CMA can provide the information you need to make informed decisions without needing a real estate agent.

Benefits of Working With a Real Estate Professional:

1. By working with our Property Team, clients can access all the services that top real estate agents in the country provide at a significantly lower flat fee. This cost-effective approach will save them substantial money throughout the real estate process.

2. Our Property Team consists of experienced local professionals well-versed in the real estate market. They have the knowledge and expertise to guide clients through every step of the buying or selling process, ensuring that you make informed decisions and avoid costly mistakes.

3. Working with a real estate professional from our team means having access to their extensive network of contacts. These connections can be invaluable in finding potential buyers or sellers and accessing off-market properties that may not be available to the general public.

4. Our team of real estate professionals deeply understands the local market and can provide valuable insights into current trends, pricing, and market conditions. This knowledge lets clients make strategic decisions and negotiate the best possible deals.

5. Selling or buying a property can be complex and time-consuming. Our team of local attorneys handles all the paperwork, negotiations, and logistics, saving clients valuable time and reducing stress. They take all the details, ensuring a smooth and efficient transaction.

6. Real estate transactions often involve legal and financial complexities. Our real estate professionals have the expertise to navigate these complexities and ensure that all legal and financial aspects are handled correctly. This helps to protect clients’ interests and provides a legally sound transaction.

7. Our Property Team provides personalized attention and tailored solutions to meet clients’ needs. They take the time to understand their client’s goals, preferences, and budgets and then develop a customized strategy to achieve the desired outcome.

8. Working with a real estate professional also gives clients a sense of security and peace of mind. They can rely on the expertise and guidance of a trusted professional dedicated to their best interests throughout the process.

9. Our Property Team has a proven track record of success, with numerous satisfied clients who have achieved their real estate goals with assistance. This reputation for excellence and client satisfaction further reinforces the benefits of working with our real estate professionals.

10. Ultimately, working with our Property Team is a smart investment. Clients receive top-notch service, extensive resources, and significant cost savings, so deciding to work with a real estate professional from our team is wise and advantageous.

Online Tools for Determining Your Home Value

Determining the value of your home is a crucial step when it comes to selling it. While some may opt to work with real estate agents for this purpose, others prefer exploring online tools that can provide accurate estimates. These tools utilize factors such as square footage, sale price data, public records, and market trends to determine a ballpark estimate of your home’s worth. Online valuation tools have gained popularity due to their convenience and cost-effectiveness. By leveraging these tools, homeowners can get a preliminary idea of their property’s value, enabling them to make informed decisions regarding listing prices and negotiating with potential buyers. In this article, we will explore the benefits and functionalities of online tools for determining your home’s value, offering insights on how they can contribute to your selling process.

Public Records & Square Footage of Your Home

Public Records & Square Footage of Your Home: A Valuable Resource

When determining the value of your property, accurate square footage is crucial. While many individuals rely on real estate agents or costly appraisal services for this information, public records can provide a cost-effective solution. By accessing public records, you can find the square footage details of your home, enabling you to make informed decisions regarding its value.

Utilizing public records to determine square footage is a simple process. Here are the steps to follow:

1. Research your county’s office of the assessor or tax assessor’s website. They typically maintain public records of properties within their jurisdiction, including square footage information.

2. Locate the property search function on the website. This may require you to provide basic details such as the property address, owner’s name, or tax assessment number.

3. Once you’ve found the correct property, navigate to the property details section. Here, you should find information such as lot size, number of bedrooms and bathrooms, and, most importantly, the home’s square footage.

By accessing public records, you can determine the accurate square footage of your home and ensure its value is properly assessed. With this knowledge, you can confidently decide on pricing, potential renovations, or refinancing options. Remember, accurate information is key in real estate, and public records provide a valuable resource for obtaining it.

Sale Price & Fair Market Value of Comparable Homes in Your Area

Determining the sale price and fair market value of comparable homes in your area is essential when selling your property. While real estate agents may provide this information, you can research recently sold homes in the same neighborhood to save on costs.

Start by researching online tools or websites that provide data on recently sold homes in your area. Look for homes with similar square footage, bedrooms and bathrooms, and similar features to your property. Take note of their sale prices and calculate the average price per square foot.

Consider other factors that may affect the value of the homes, such as the average time these properties spent on the market before being sold. This will give you an idea of your area’s demand and market conditions.

It’s also important to analyze the competition in your neighborhood. Take note of the number of homes currently for sale and their asking prices. This information will help you gauge the competitiveness of your listing.

By researching recently sold homes and considering important factors like sale price, price per square foot, average time on the market, and assessing the competition, you can determine a fair market value and set an appropriate sale price for your property.

External Factors That Impact the Value of Your Home

When determining the value of a home, it’s important to consider not just the property itself but also the external factors that can influence its value. These factors play a significant role in home valuation and are highly important to prospective buyers. Here are some key external factors to consider:

1. Neighborhood Safety: Buyers prioritize safety when choosing a home. A safe neighborhood with low crime rates can significantly increase the value of a property. Homeowners and families alike look for a secure environment to call home.

2. Nearby Schools: The quality of nearby schools directly impacts home values. Properties located in highly sought-after school districts often command higher prices. Buyers with children or plans for a family prioritize access to good education options.

3. Surrounding Homes: The value of a home can also be affected by the properties surrounding it. Buyers are more likely to be interested in a home if the neighboring houses are well-maintained and aesthetically pleasing. On the other hand, if the surrounding homes are dilapidated or poorly maintained, it can negatively impact the property’s value.

4. Environmental Factors: Environmental aspects, such as proximity to parks, recreational facilities, and natural attractions, can influence home values. Additionally, factors like noise pollution, air quality, and access to green spaces play a role in the desirability of a location.

Considering these external factors alongside the property’s features and condition will provide a more comprehensive understanding of its value. By highlighting these factors, sellers can showcase the full potential of their homes to prospective buyers and make informed decisions, even without a realtor.

Special Features & Upgrades That Increase Your Home’s Value

Special features and upgrades can make a significant difference when determining your home’s value. These enhancements not only improve your property’s overall functionality and aesthetics but also have the potential to increase its market value.

Updating interior finishes is one such feature that can instantly elevate the value of your home. Consider modernizing your kitchen with high-quality countertops, cabinets, and flooring. Upgrading appliances and incorporating tech features, such as smart thermostats or security systems, can also appeal to buyers looking for convenience and energy efficiency.

Enhancing curb appeal is another crucial factor boosting your home’s value. Simple improvements, like a fresh coat of paint, landscaping enhancements, or an attractive front door, can make a lasting impression on potential buyers.

Increasing your home’s square footage is another surefire way to increase its value. Adding an extra room, expanding an existing one, or finishing a basement can all provide buyers with more living space, thereby increasing the desirability and worth of your property.

By investing in these special features and upgrades, you can enjoy a higher selling price for your home. Consider your specific market preferences and consult a professional to ensure that your improvements align with current market trends and offer a significant return on investment.

Current Market Conditions & Trends

Understanding the current market conditions and trends is essential when determining the worth of your house. The real estate market constantly evolves, influenced by supply and demand, economic conditions, and buyer preferences. Staying informed about these market conditions can help you accurately assess the value of your property. Keep an eye on the local housing market to identify if it favors buyers or sellers, as this can impact the overall worth of your home. Additionally, consider market trends such as popular neighborhood amenities, housing preferences, and buyer demographics. These trends can provide valuable insights into what potential buyers seek, allowing you to position your property and maximize its value strategically. Whether through online tools, real estate professionals, or local market reports, staying abreast of current market conditions and trends will help you obtain an accurate estimate of your house’s worth.

Monitoring Local Real Estate Markets to Determine Accurate Valuations

Monitoring local real estate markets is crucial for homeowners who want to determine accurate property valuations. Staying informed about current market conditions and trends can provide valuable insights into the value of a home.

To determine an accurate valuation, homeowners should consider recent sales records, market factors, and sustainable market trends. Current sales records can give homeowners an idea of the sale price of similar properties in their area, allowing them to assess their property’s worth.

Market factors such as housing demand, interest rates, and economic conditions can also impact property values. By closely monitoring these factors, homeowners can better understand the current market conditions and how they may affect their property’s value.

Furthermore, a network of buyers and real estate professionals can be a valuable resource. By connecting with these individuals, homeowners can gather information about the current market and receive valuable insights from those involved in real estate transactions.

Ultimately, monitoring local real estate markets is essential for homeowners who want to determine accurate property valuations. Homeowners can make informed decisions about their property’s worth by staying knowledgeable about current market conditions and trends and utilizing a network of buyers and real estate professionals.

Understanding Curb Appeal and Its Role in Determining the Value of a Home in Palm Beach County

Curb appeal plays a crucial role in determining the value of a home. It refers to a property’s attractiveness and overall visual appeal from the street. Landscaping, exterior condition, and overall presentation can significantly impact a home’s perceived value.

Landscaping is an essential element of curb appeal. A well-maintained lawn, neatly trimmed hedges, and vibrant plants can enhance the visual appeal and create a positive first impression for prospective buyers. On the other hand, neglecting landscaping can make a property appear run-down and decrease its value.

The exterior condition of a home is equally important. A fresh coat of paint, clean windows, and a well-maintained roof can significantly improve a home’s curb appeal. Conversely, peeling paint, cracked windows, or a worn roof can give the impression of neglect and reduce the value of a property.

Overall, the presentation also plays a role in curb appeal. Simple enhancements such as updating the front door with a modern design, adding a fresh coat of paint to the exterior, and tidying up the yard can make a substantial difference. Other improvements include installing attractive outdoor lighting fixtures, adding decorative elements like shutters or window boxes, and ensuring the driveway and walkway are clean and well-maintained.

By focusing on these aspects of curb appeal, homeowners can increase their property’s perceived value and attract more potential buyers. It is important to remember that first impressions are often lasting, and a well-presented exterior can significantly impact the real estate market.

Utilizing Valuation Models to Make an Accurate Estimate

When determining the value of a home, many factors come into play. While hiring a real estate agent is common, there may be more cost-effective solutions. However, with the assistance of valuation models, homeowners can make accurate estimates independently.

Valuation models incorporate various factors to understand a property’s value comprehensively. One key aspect is the property’s characteristics, such as size, layout, condition, and special features. These details contribute to the overall appeal and desirability of the home, thereby affecting its value.

Another important factor considered is the recent sales history in the area. By analyzing comparable properties that have recently sold, valuation models can identify trends and patterns in the local market. This comparative market analysis helps to determine a fair market value for the home in question.

Valuation models also take into account the current market conditions. Considering supply and demand, interest rates, and economic trends can provide a more accurate estimate of a property’s worth. This insight can benefit homeowners looking to sell in a sustainable market.

By incorporating property characteristics, recent sales history, and local market conditions, valuation models offer homeowners a comprehensive approach to determining their home’s value. This accurate estimate enables informed decision-making regarding setting a listing price or considering prospective buyers. With the help of these tools, individuals can confidently navigate the real estate market without relying solely on real estate agents.

Using Homes For Sale as a Guide When Pricing Your Property

When pricing your property, one valuable resource to consider is the local real estate market and the homes for sale. By researching and analyzing the listings of comparable homes in your area, you can better estimate your property is worth.

Start by searching for homes for sale in your neighborhood or surrounding areas. Look for properties similar in size, layout, condition, and features to yours. These comparable homes will serve as a guide for pricing your property.

Pay attention to the sale prices of these homes. This will give you an idea of what buyers will pay in the current market. Consider the price per square foot as well, as this metric can help you assess the value of your property based on its size.

By studying the homes for sale in your local real estate market, you can gauge the demand and supply dynamics and current market trends. This information will be instrumental in determining a competitive and realistic price for your property.

Remember, while hiring a realtor is one way to gather this information, it can be costly. With the right resources and research, you can leverage the power of homes for sale to price your property and make a well-informed decision independently.

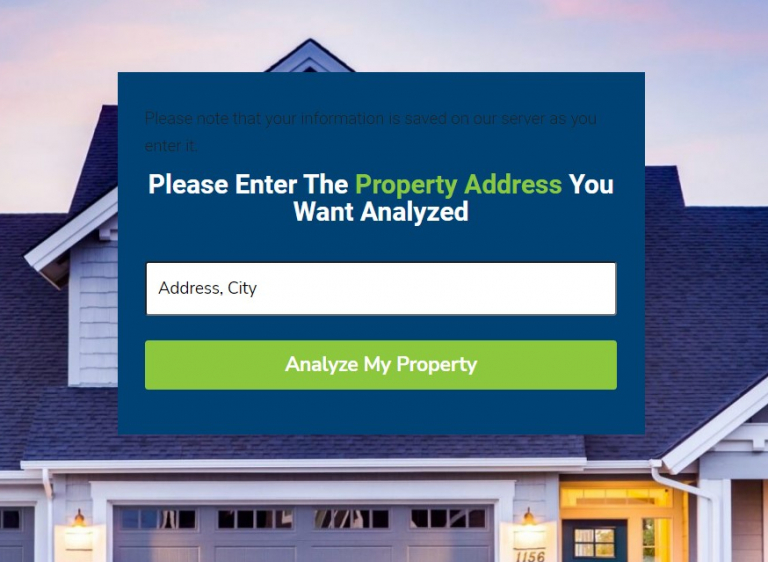

FREE online home valuation tool

Basically, our home valuation tool will give you a better understanding of the value of your property as you prepare to enter the real estate market. In Addition, a valuation is not an appraisal. It is a starting point in determine your home’s value in today’s market

Start with our FREE valuation tool (obviously), our system compares similar homes sold recently around the area. To get a more exact valuation/appraisal, contact us today and get by all means the most exact type of appraisal to determine your home’s worth in the market today

Firstly, the accuracy is as good as the amount of data available in your area. And secondly we strongly recommend to talk to one of our professionals before deciding the final price for your listing. Being that every house is different and needs different tools at last. Our data is gathered from the county’s website.

Generally a home valuation is a good starting point to have an idea of what your property might be worth in the market today. An appraisal is conducted by a professional and might be more accurate indeed in determining the price of your home at all. To learn more about home valuations and home appraisals in detail read: Home valuations and appraisals.